Financial statements made simple: A guide to reading balance sheets, income statements, and cash flow statements

Understanding financial statements is key for investors. They reveal a company’s assets, liabilities, income, and cash flow. For example, Coca-Cola's balance sheet shows what it owns and owes, while its income and cash flow statements highlight profitability and cash management.

Understanding financial statements is essential for every investor. Think of these documents as the language of business. If you don't speak the language, investing can feel like ordering from a menu in a foreign country - you might end up with a surprise dish! This guide walks you through the basics of the three key financial statements: the balance sheet, income statement, and cash flow statement, using Coca-Cola as our example.

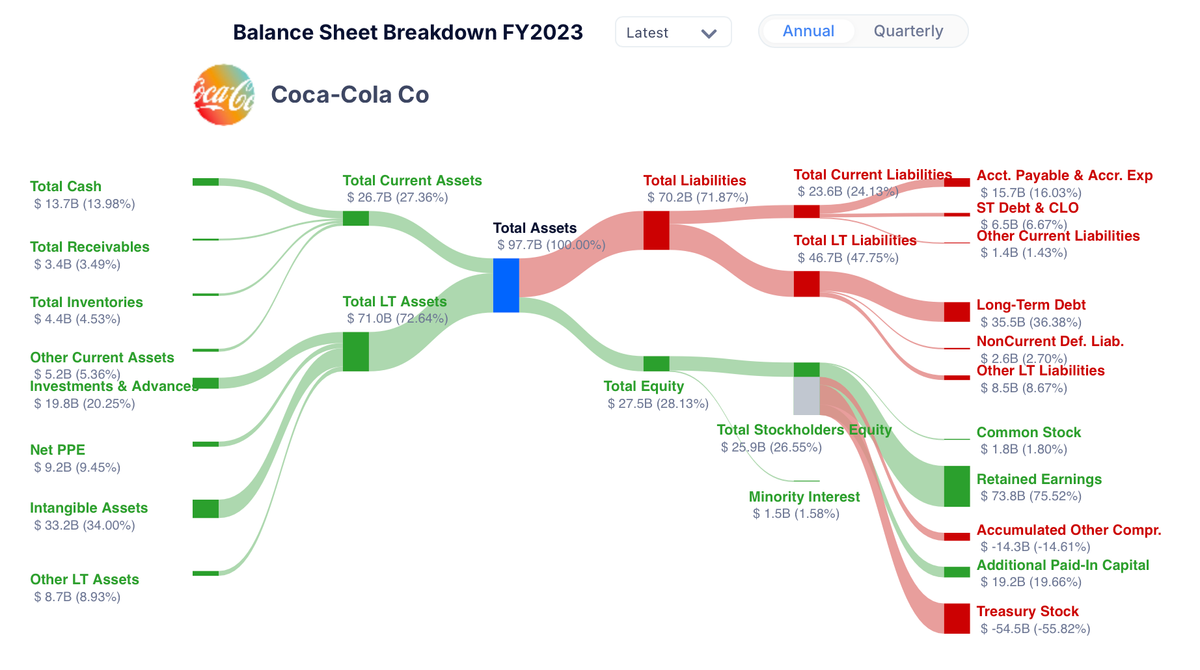

The Balance Sheet: A Snapshot of What the Company Owns and Owes

The balance sheet is a company’s financial snapshot, capturing everything it owns and owes at a specific moment in time. It’s divided into two main sections:

- Assets (what the company owns)

- Liabilities and Equity (what the company owes and what owners have invested)

For Coca-Cola, here’s how it looks:

- Assets: Coca-Cola has total assets of $97.7 billion, which includes $13.7 billion in cash, $3.4 billion in receivables, and $33.2 billion in intangible assets.

- Liabilities and Equity: On the other side, Coca-Cola has $70.2 billion in total liabilities, including $35.5 billion in long-term debt, and $27.5 billion in total equity, representing the owners’ stake.

So, in balance sheet terms:

Assets = Liabilities + Shareholders’ Equity

Example Breakdown:

- Assets: $97.7 billion (including cash, receivables, and intangible assets)

- Liabilities: $70.2 billion (such as long-term debt)

- Equity: $27.5 billion (shareholders’ ownership stake)

This balance sheet is Coca-Cola’s financial “snapshot.” As the company grows, it may add more assets (like new equipment or brands) and potentially take on more liabilities (like loans or supplier credit).

Analogy Tip: Think of the balance sheet as a “snapshot” of a company’s financial condition at a moment in time.

The Income Statement: Tracking Revenue and Expenses Over Time

The income statement reveals a company’s revenue (income from sales) and expenses (costs of running the business) over a specific period, such as a month, quarter, or year. It helps investors see how profitable a business is.

For Coca-Cola in FY2023:

- Revenue: $45.8 billion from global sales across regions like North America ($16.8 billion) and Europe, Middle East & Africa ($8.1 billion).

- Cost of Goods Sold (COGS): $18.5 billion, covering the costs of producing beverages.

- Gross Profit: $27.2 billion (Revenue - COGS).

- Operating Expenses: $14.2 billion, including Selling, General, and Administrative (SG&A) expenses of $7.9 billion.

- Net Income: After accounting for other expenses, interest, and taxes, Coca-Cola’s net income is $10.7 billion.

Analogy Tip: Think of the income statement as the “routine” a company follows over time - it shows how each decision (like selling more or controlling costs) impacts profitability.

The Cash Flow Statement: Following the cash trail

The cash flow statement shows how cash moves in and out of a business, broken down into three main sections:

- Cash from Operations: Cash generated from day-to-day business activities.

- Cash from Investing: Cash used or earned from buying and selling long-term assets.

- Cash from Financing: Cash from loans, stock issuance, or debt repayments.

For Coca-Cola in FY2023:

- Cash from Operations: Coca-Cola generated $11.6 billion in cash from its business operations.

- Cash from Investing: The company spent $3.3 billion on investments, including capital expenditures for long-term growth.

- Cash from Financing: Coca-Cola used $8.8 billion for financing activities, such as paying dividends and repaying debt.

Cash Flow Overview:

- Cash from Operations: $11.6 billion

- Cash from Investing: -$3.3 billion

- Cash from Financing: -$8.8 billion

The cash flow statement reveals Coca-Cola's cash management, showing whether it generates enough cash to cover expenses and invest in growth.

Analogy Tip: Think of the cash flow statement as the “budget” for a business - it shows how effectively cash is managed to cover needs and fuel expansion.

Depreciation and amortization: Spreading out costs over time

Some large expenses, like purchasing equipment or acquiring intangible assets, don’t appear as one-time costs on the income statement. Instead, they’re “capitalized” and depreciated or amortized over several years.

For Coca-Cola: Let’s say Coca-Cola purchases equipment for $50 million, expected to last 10 years. The equipment’s depreciation expense would be $5 million per year ($50 million divided by 10 years). This approach spreads the cost over the equipment’s useful life, giving a clearer picture of annual profitability by avoiding a single large expense in one year.

Putting it all together: How the statements interconnect

The three financial statements are interlinked. Here’s how:

- The income statement’s net income flows into retained earnings on the balance sheet.

- Depreciation on the income statement affects the cash flow statement as a “non-cash” expense.

- Cash flow from operations begins with net income from the income statement and ends with a total that feeds back into the balance sheet under cash and equivalents.

Together, these three statements offer a holistic picture of a company’s financial health, enabling investors to spot strengths, weaknesses, and growth opportunities.

Tips for investors: Key areas to watch

Here’s what to look for in each financial statement:

- Balance Sheet: Look for a healthy balance between assets and liabilities. High debt relative to equity can signal risk.

- Income Statement: Watch for strong profit margins (net income as a percentage of revenue). High margins can indicate efficient management and pricing power.

- Cash Flow Statement: Positive cash flow from operations suggests that the business generates enough money to fund its activities without relying heavily on new loans.

Financial statements might seem daunting, but with practice, they become one of the most powerful tools for making informed investment decisions. Whether you’re investing in a major corporation or a small local business, mastering these basics will help you understand the true health of any company.