How Warren Buffett made his first million: A journey from penny-pinching to portfolio-building

Warren Buffett, one of the most successful investors of all time, didn’t start his journey with a silver spoon or a family inheritance. Born in 1930, his path to becoming a millionaire by age 31 was paved with tenacity, a deep fascination with numbers, and a sheer determination to make it big.

Warren Buffett, one of the most successful investors of all time, didn’t start his journey with a silver spoon or a family inheritance. Born in 1930, his path to becoming a millionaire by age 31 was paved with tenacity, a deep fascination with numbers, and a sheer determination to make it big. While today he’s known for managing billions through Berkshire Hathaway, in his early years, Buffett focused on micro-sized investments and what he called the “cigar-butt” strategy—buying cheap companies that still had one “puff” of profit left in them.

INSERT IMAGE HERE OF YOUNG WARREN BUFFETT SELLING NEWSPAPERS

Early Hustle: Chewing gum, coke, and newspaper routes

Even as a young boy, Buffett had a knack for turning a profit. At six years old, he started selling chewing gum and Coca-Cola door-to-door in his neighborhood, making a couple of pennies per pack. By his early teens, he’d moved on to delivering newspapers, often working multiple routes to maximize his earnings. By age 14, he was already the proud owner of $1,000 (worth nearly $15,000 today) through his paper routes alone. That year, he filed his first tax return, even humorously deducting his bicycle and watch as "business expenses"—an early sign of his financial savvy.

Lessons from his first investment

At 11, Buffett dove into the stock market, investing $120 he’d saved in three shares of a company called Cities Service Preferred. But this initial investment taught him lessons the hard way. His shares dropped in value immediately after purchase, a stomach-turning experience for someone who had poured in all his savings. When the stock eventually recovered, Buffett sold for a small profit, only to watch it soar shortly after. This taught him two invaluable lessons: don’t fixate on the price you paid, and don’t rush to grab a small profit. These early mistakes would later shape his legendary patience and commitment to long-term value.

A lifelong bookworm and the power of value investing

Buffett was an insatiable reader, devouring every book on finance and investing he could get his hands on. At age 19, he discovered Benjamin Graham’s book, The Intelligent Investor, which forever transformed his outlook. Graham’s emphasis on value investing—buying stocks for less than their intrinsic worth—became the core of Buffett’s investment philosophy. Soon, he was analyzing companies from the ground up, reading Moody’s Manuals and studying financial statements to build a mental database of stocks.

Small partnerships and big returns

After studying under Graham at Columbia, Buffett returned to Omaha and started Buffett Associates Limited, a small investment partnership modeled after Graham’s approach. This allowed Buffett to apply his learnings and invest in what he affectionately referred to as “cigar-butt” stocks—companies trading at rock-bottom prices that still offered a few puffs of profit.

Buffett didn’t shy away from concentrated bets. For instance, he invested a large share of the partnership’s funds in Sanborn Map Company, a company whose stock price was far below the value of its assets, and Dempster Mill Manufacturing, a farm equipment company with untapped value on its balance sheet. These investments generated significant returns, and Buffett’s partnerships began outperforming the market by substantial margins, compounding at a jaw-dropping 16% above the Dow Jones average.

From cigar butts to a millionaire mindset

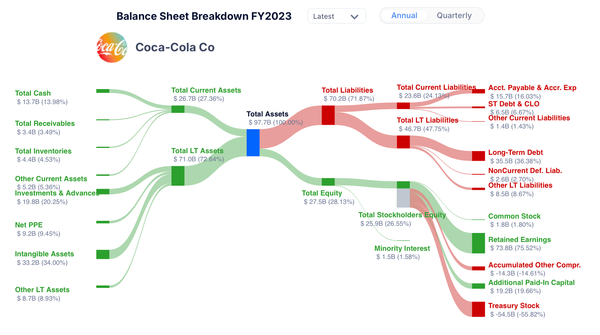

Despite his success with cigar-butt investments, Buffett’s approach would eventually evolve, thanks in part to his friendship with Charlie Munger. Munger convinced him that it was better to focus on great companies at fair prices rather than mediocre companies at bargain prices. This shift opened up a world of more sustainable investments in high-quality businesses—an insight that would later lead him to invest in household names like Coca-Cola and American Express.

A millionaire at 31: Focus, frugality, and relentless determination

By age 31, Buffett was officially a millionaire, with his share of partnership profits and a personal net worth of $1,025,000. He’d reached this milestone through a combination of early entrepreneurial ventures, disciplined investing, and above all, an unwavering focus on building wealth. Every decision, whether investing in a company or saving on personal expenses, was driven by his goal to achieve financial freedom.

Buffett’s journey to his first million is more than a tale of stock-picking. It’s a story of grit, frugality, and relentless learning. He constantly looked for ways to improve and avoided the common pitfalls of chasing trends. Instead, he relied on his own research, long-term focus, and willingness to go against the grain.

Warren Buffett’s path to a million dollars is a powerful lesson in patience, preparation, and principled investing. His story reminds us that building wealth doesn’t necessarily require massive capital to start with. Instead, it’s about recognizing opportunities, sticking to sound principles, and never giving up—no matter how small the initial steps might seem.