Klaveness Combination Carriers

Klaveness Combination Carriers ASA is a leader in sustainable, dual-cargo shipping, specializing in both dry bulk and tanker markets. Leveraging innovative vessels, KCC optimizes operations by minimizing ballast voyages, achieving up to 40% lower emissions.

Investment thesis

Klaveness Combination Carriers ASA (KCC) is a pioneering force in the shipping industry, strategically positioned to address critical challenges of operational efficiency and environmental impact. Founded in 2018 with over 70 years of industry legacy through the Torvald Klaveness group, KCC operates a fleet of innovative combination carriers that can seamlessly transport both dry bulk and tanker cargo. This dual-cargo capability - enabled by the CABU vessels, which specialize in transporting caustic soda and bulk cargo, and the CLEANBU vessels, optimized for both clean petroleum products and bulk cargo - allows KCC to minimize ballast voyages, reducing fuel consumption and emissions by up to 40% compared to conventional carriers.

KCC’s model not only enhances fleet utilization and voyage planning but also stabilizes revenue generation, appealing to clients who prioritize both efficiency and sustainability. This unique approach positions KCC as a leader in sustainable shipping logistics, especially as regulatory and market pressures increase for reduced emissions. Although KCC’s dual-market exposure offers flexibility, it is also subject to macroeconomic and regulatory risks that could impact demand and utilization rates.

In balance, KCC’s strong positioning in sustainable logistics, combined with a financially disciplined approach and an innovative operating model, supports its potential for stable growth and profitability.

The world’s most carbon efficient deep-sea shipping solution within the tanker and dry bulk segment

Financial history

Since its founding, KCC has shown steady financial growth, supported by its niche in dual-cargo shipping. The company’s premium earnings model, which maximizes laden legs per voyage, allows for high revenue consistency even amid cyclical market conditions. This mitigates earnings volatility typically seen in the dry bulk and tanker markets.

Recent financial highlights from Q3 2024 show that KCC has maintained strong performance despite softer market conditions:

- EBITDA: USD 32.6 million in Q3 2024.

- TCE (Time Charter Equivalent) Earnings: CLEANBU TCE earnings held steady at $38,673/day, while CABU TCE earnings were slightly impacted, at $29,668/day, due to weaker caustic soda shipment volumes and MR-tanker market conditions.

Driven by high demand for dual-cargo shipping solutions, KCC has achieved stable revenue growth across recent quarters. The company’s unique ability to switch between cargo types has consistently allowed it to maintain optimal fleet utilization, a feat not easily matched by competitors reliant on single-segment shipping.

KCC’s dual-revenue structure from both dry bulk and tanker shipments helps insulate it from market volatility, contributing to earnings stability that appeals to investors looking for resilient cash flows.

Klaveness quality check

Each investor has unique criteria for defining "quality" in their investments. My approach to evaluating quality involves assessing several key parameters, which are outlined in the checklist below:

Profitability

- Return on Assets: Positive

- Operating Cash Flow: Positive

- Change ROA (Cur. year > Prev. year): Yes

- Operating Cash Flow/Total Assets > ROA: Yes

Leverage

- Change Leverage (Cur. year < Prev. year): Yes

- Change Current Ratio (Cur. year > Prev. year): Yes

- Change Shares (Cur. year >= Prev. year): No

Operating Efficiency

- Change in Gross Margin (Cur. year > Prev. year): Yes

- Change in Asset Turnover ratio (Cur. year > Prev. year): No

Owner's Earnings & EPS

- Owner's Earnings: 124%

- Number of Years with EPS Growth: 5

Based on these metrics, Klaveness clearly passes the quality check, demonstrating strong profitability, improving leverage, and effective operating efficiency. This solid financial performance positions Klaveness as a quality company in the market.

Klaveness business model

Klaveness Combination Carriers (KCC) operates an innovative dual-cargo model that leverages the unique flexibility of its fleet to transport both wet and dry cargo, minimizing ballast time and maximizing operational efficiency. This hybrid approach, enabled by KCC’s two primary vessel types - CABU and CLEANBU - allows the company to dynamically adjust to shifting market demands across both tanker and dry bulk markets. By optimizing vessel utilization through strategic cargo-switching, KCC achieves greater revenue stability and mitigates earnings volatility that typically affects the shipping industry.

The CABU vessels are optimized to carry caustic soda and bulk cargo, with particular strength in meeting demand from export hubs in Australia. This division reduces empty return voyages, enhances asset utilization, and contributes to revenue consistency, particularly in stable markets like caustic soda transport. CLEANBU vessels, on the other hand, add versatility to KCC’s operations, allowing seamless transitions between clean petroleum products and dry bulk cargo. This adaptability positions KCC to capitalize on diverse cargo needs and capture revenue across both tanker and bulk segments, outperforming single-segment competitors in terms of flexibility and utilization.

KCC’s dual-cargo model provides strategic advantages that extend beyond operational efficiency. By aligning its assets with high-demand, low-carbon shipping solutions, KCC not only supports client needs for sustainable logistics but also adheres to tightening environmental regulations. This eco-efficient approach reduces emissions per ton-mile by up to 40%, further solidifying KCC’s position as a leader in sustainable shipping and enhancing its appeal to environmentally conscious clients.

In essence, KCC’s business model combines operational resilience with a commitment to sustainability. By maximizing laden voyages and minimizing ballast, KCC not only secures stable and predictable revenue but also positions itself as a forward-thinking leader in the evolving landscape of maritime logistics.

Rising demand for dual-cargo shipping and environmental efficiency

The demand for shipping solutions that reduce emissions and enhance efficiency has surged due to regulatory and market pressures. The International Maritime Organization (IMO) aims to cut annual greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008 levels. KCC's combination carriers meet this demand with an estimated 30-40% reduction in fuel consumption, leading to lower emissions per ton-mile compared to traditional tankers and dry bulk vessels. Additionally, the dual-cargo approach helps clients navigate fluctuating commodity markets while minimizing costs associated with ballast voyages, positioning KCC as a viable player in a market that increasingly prioritizes sustainable and versatile shipping.

Increasing demand for sustainable shipping solutions

The need for environmentally friendly shipping options has intensified, particularly with stricter international maritime regulations, such as the IMO 2023 guidelines on greenhouse gas emissions. Shipping companies are increasingly motivated to adopt low-carbon and fuel-efficient technologies. KCC’s combination carriers, which achieve up to 40% lower emissions per ton-mile compared to conventional tankers and dry bulk carriers, are well-aligned with these trends. The CABU and CLEANBU fleets minimize empty transit time, substantially reducing emissions and fuel costs per voyage.

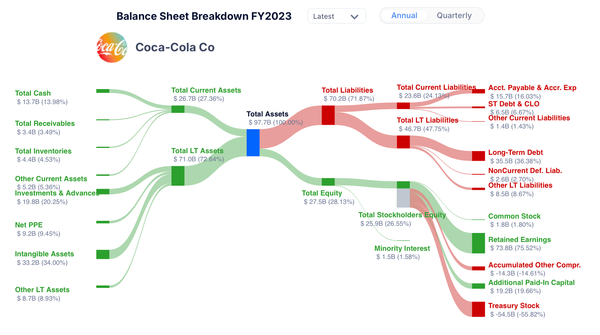

Balance Sheet & Debt

Balance Sheet & Debt

- Intangible Assets / Total Assets: 0%

- Net Debt/EBITDA: 1.20

- Net Debt/Equity: 46.6%

- Total Debt/Total Assets: 39%

Market position and Moat

1. Unique combination carrier model:

KCC’s ability to shift between cargo types allows it to capture opportunities in both dry bulk and tanker markets. This flexibility minimizes ballast voyages, enhances fuel efficiency, and positions KCC as a competitive player in both markets. The company's operational flexibility is particularly valuable in fluctuating markets, offering a more stable revenue base than traditional single-segment carriers.

2. Established reputation and expertise:

With decades of experience in dual-cargo shipping, KCC has developed specialized knowledge in vessel design, crew management, and operational excellence. This legacy of expertise enhances trust among clients and stakeholders, while also bolstering KCC’s ability to navigate complex logistics with high efficiency.

3. Strong barriers to exit:

KCC’s combination carrier model creates high switching costs for clients, who benefit from the dual-cargo capability, reduced emissions, and lower transit costs. These advantages make it challenging for competitors to lure clients away, solidifying KCC’s market position and long-term client retention.

4. Sustainability edge:

In an industry increasingly focused on reducing emissions, KCC’s commitment to eco-efficient shipping is a competitive advantage. The company's vessels achieve up to 40% lower emissions per ton-mile than standard carriers, making KCC an attractive partner for customers who prioritize sustainability.

Capital requirements: Lean and efficient

Investors often look for companies that don’t burn cash just to stay afloat.

Capital intensity

- CAPEX/Sales < 5%: No

- CAPEX/Operating Cash Flow < 25%: Yes

Capital allocation

I prioritize companies that strategically allocate capital across multiple areas: reinvesting in their core business, pursuing acquisitions that strengthen competitive advantages, and returning excess funds to shareholders through dividends or share buybacks.

Capital allocation

- Pays dividend: Yes

- Return on Invested Capital: 19.0% (R12)

- Number of shares: The company has issued shares in the past five years.

Klaveness maintains a modest dividend payout, a positive aspect of its capital allocation strategy. With an ROIC of 19.0% over the last twelve months and a Q3 2024 ROCE of 17%, the company demonstrates solid performance despite challenging market conditions.

Stock price

Klaveness has faced a 9.77% decline in its stock this year, despite outperforming the broader dry bulk and product tanker markets. In Q3 2024, the company achieved strong EBITDA and gross profit, driven by resilient CLEANBU earnings despite weak spot markets, while CABU earnings were impacted by a softer tanker market. Additionally, Klaveness reached a record-low carbon intensity level, thanks to efficient trading operations.

Looking ahead to 2025, Klaveness anticipates continued robust performance, leveraging its combination trading model to deliver premium earnings compared to traditional tankers and dry bulk carriers.

Klaveness's outlook

1. Product Tanker Market

The tanker market, affected by recent macroeconomic pressures, shows signs of recovery, especially with seasonal demand expected to pick up in Q4 2024. KCC’s dual-cargo model positions it well to benefit from any rebound, as well as potential easing of OPEC+ production cuts.

2. Dry Bulk Market

The dry bulk market remains strong, supported by global demand for commodities. Limited fleet growth provides favorable conditions for KCC’s fleet to maintain high utilization rates. Despite weakness in the European market, high Chinese demand and steady fronthaul shipments are expected to sustain revenue levels into 2025.

| (Million USD) | 2022 | 2023 | 2024e | 2025e | 2026e |

|---|---|---|---|---|---|

| Revenues | 165 | 197 | 195 | 193 | 215 |

| EBIT | 76 | 103 | 98 | 91 | 105 |

| EV/EBIT | 7.9 | 6.8 | 6.4 | 7.0 | 6.7 |

| EPS | 1.16 | 1.51 | 1.39 | 1.27 | 1.44 |

| P/E | 5.7 | 5.5 | 5.2 | 5.7 | 5.1 |

| Net debt/EBITDA | 2.37 | 1.32 | 1.44 | 1.41 | 11.82 |

| ROE | 22.1% | 26.4% | 23.2% | 20.7% | 22.5% |

Date: 2024-11-07

Valuation

In my assessment, Klaveness appears undervalued, with its high quality, strong market position. A fair value price of €105.7, implying a P/E of 7 based on the estimated 2024 EPS. Also, I do believe, the risk-adjusted return compared to peers, Klaveness deserves a premium valuation compared to peers.

- Fair Value Price: NOK 105.7

- Current Market Price: NOK 78.2 (2024-11-07)

Based on today's closing price of NOK 78.2, there is a margin of safety of roughly 46%, suggesting that the stock is currently undervalued relative to its intrinsic value.

Historically, Klaveness's 5-year average P/E ratio stands at 8.7, approximately 89% higher than the current P/E ratio of 4.6.

For transparency, I do own shares in Klaveness at the time of writing.

Historical returns are not indicative of future performance.